Investing in Vapor Corp.? April 13 2015

Summary

- The E-cigarette and Vaporizer market is expected to grow at an annualized rate of more than 27% in the coming decade.

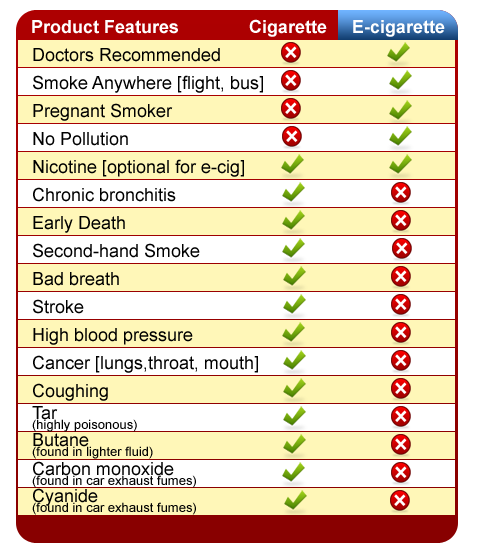

- Advantages over traditional cigarettes are related to cost, health, social acceptability and regulatory.

- The tricky part is finding cash-generating pure plays on the industry as the big tobacco companies are going to create tough competition.

For the life of me I don't understand it, but people love to smoke. I suppose I can understand people who started decades ago, because back then the evidence wasn't so blindingly clear that there is a very good chance that smoking will cause premature death.

I guess a big part of the problem today is that people get addicted as young adults before they realize that they are not immortal. By the time they appreciate the fact that they can't take for granted the fact that they will live to 90 they are already addicted.

For those people who are addicted to smoking I'm sure going out socially these days is extremely inconvenient for them. Thankfully for the rest of us smoking is banned in most indoor public places in North America.

For those smokers who feel like chewing their hands off when they are out socially because they aren't allowed to smoke there is now an alternative in the form of e-cigarettes and vaporizers. Since this has the potential to be a high-growth market I decided to start trying to find investible opportunities to ride that growth wave. The first pure-play e-cigarette and vapor company that I came across while doing a search on Seeking Alpha was the appropriately named Vapor Corp (NASDAQ:VPCO).

What follows some fact gathering about the company and the industry.

The Market for Vaporizers and Electronic Cigarettes

According to BIS Research the e-cigarette global market is estimated to grow to $39.6 billion by the end of 2024 which represents 27.3% growth rates from 2014 until then. I have to admit that I was shocked at this rate of projected growth. It would be hard to imagine another industry set to grow at those kinds of rates over the next decade.

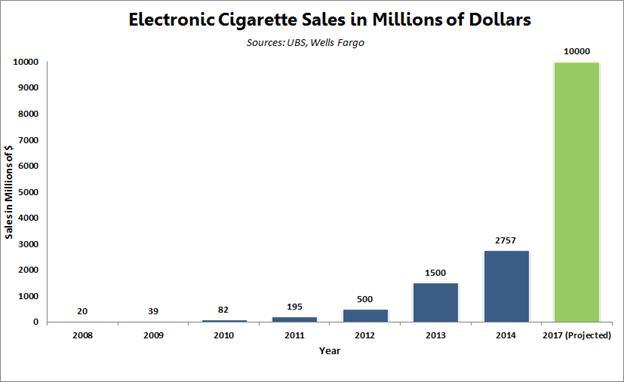

As can be seen in the image below, UBS/Wells Fargo is also predicting a very fast rate of growth for the industry with a near quadrupling of sales by 2017.

Source of image: quitday.org

The growth in the industry over the next few years can be attributed to a few key factors. These would include:

- Continued awareness of the health risk of tobacco increasing

- More restrictions being imposed on traditional cigarettes

- The entry of the tobacco giants in the e-cigarette market

- The fact that e-cigarettes are not subject to the same marketing restrictions as tobacco cigarettes

- Lower cost for the consumer of e-cigarettes over tobacco cigarettes

- Tax advantages

- Continued advancements in product quality

What Exactly Is An Electronic Cigarette / Vaporizer

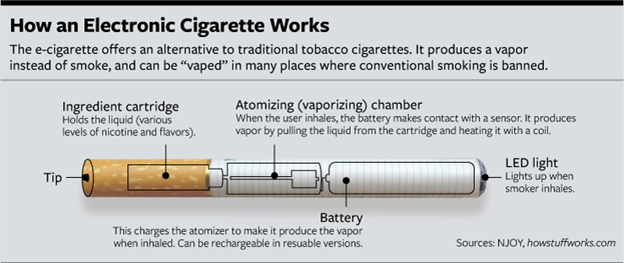

An electronic cigarette is a battery operated device which simulates the experience of tobacco smoking without the inhalation of smoke. The intention is for the electronic cigarette to offer a "smoking" experience without the burning of a tobacco leaf.

Source of image: nationaljournal.com

Vaporizers feature a tank or chamber, a heating element and a battery. The vaporizer user fills the tank with e-liquid or the chamber with dry herb or leaf. The vaporizer battery can be recharged and the tank and chamber can be refilled.

Like competitors Vapor Corp offers multiple sizes, puff counts, styles, flavors and nicotine.

In many cases vaporizers and electronic cigarettes may be used where tobacco-burning cigarettes may not. Vaporizers and electronic cigarettes may be used in some instances where for regulatory or safety reasons tobacco burning cigarettes may not be used.

Not always though as some states, cities and businesses have already banned the use of vaporizers and electronic cigarettes. The e-cigarette companies are therefore going to be relying more on the health benefits of their product because the advantage of being acceptable in public places may go away over time.

Source of image: Electroniccigarette123.com

Vapor Corp - Products And Background

Vapor Corp is a NASDAQ listed, U.S. based distributor and retailer of vaporizers, e-liquids and electronic cigarettes.

From what I can tell it is presently the only vaporizer company listed on a major stock exchange. Vapor Corp recently acquired the retail store chain "The Vape Store" as part of a merger with Vaporin, Inc.

As discussed in the industry section Vapor Corp's technology enables users to inhale nicotine vapor without smoke, tar, ash or carbon monoxide. Vapor Corp's brands include Krave, VaporX, Hookah Stix and Vaporin and are distributed to and available at approximately 50,000 retail stores throughout the U.S. and Canada. The Company sells direct to consumers via e-commerce and Company-owned brick-and-mortar retail locations operating under "The Vape Store" and "emagine vapor" brands.

Following the acquisition of Vaporin, Inc. Vapor Corp now also owns 16 retail stores, including kiosks.

Vapor Corp's products are broken in the following segments (images from Vapor Corp's website):

1) Disposable E-Cigs

Disposable electronic cigarettes feature a one-piece construction that houses all the components and is utilized until the nicotine or nicotine-free solution is depleted.

2) Rechargeable E-Cigs

Rechargeable electronic cigarettes feature a rechargeable battery and replaceable cartridge (also known as an "atomizer or cartomizer"). The atomizers or cartomizers are changed when the solution is depleted from use.

3) E-Vaporizers

Vaporizers feature a tank or chamber, a heating element and a battery. The vaporizer user fills the tank with e-liquid or the chamber with dry herb or leaf. The vaporizer battery can be recharged and the tank and chamber can be refilled.

Vapor Corp - Competition

Competition in the electronic cigarette industry, including the vaporizer and e-liquid segments, is intense. Vapor Corp competes with other sellers of electronic cigarettes in a highly fragmented market made up of large and small competitors. Those large competitors include Lorillard, Inc., Altria Group, Inc. and Reynolds American, Inc., which are big tobacco companies that have electronic cigarette business segments.

Vapor Corp - Vaporin Deal Changes Balance Sheet

It doesn't take a lot of studying to look at the December 31, 2014 balance sheet of Vapor Corp to realize that the company needed to raise some capital and it subsequently has in coordination (as a condition of) with the Vaporin acquisition.

On March 3, 2015, Vapor Corp. (the "Registrant") entered into a Securities Purchase Agreement (the "Purchase Agreement") with certain accredited investors providing for the sale of $3,500,960 in shares (the "Shares") of the Registrant's Common Stock, par value $0.001 per share ("Common Stock") at a price of $1.02 per share (the "Per Share Purchase Price").

A second condition of the acquisition was that Vapor Corp would arrange for a further $25 million of financing commitments from third parties. Given that the transaction seems to be proceeding it appears that Vapor Corp's balance sheet will be significantly improved as of the next quarterly SEC filing.

Per the prospectus explaining the Vaporin acquisition the pro-forma balance sheet of the combined entity is expected to look like this:

|

Pro Forma Balance Sheet Information |

|

|

|

|

|

|

|

||||||

|

Total current assets |

|

|

|

$ |

14,262 |

|

|

|

|

||||

|

Intangible assets |

|

|

|

|

1,750 |

|

|

|

|

||||

|

Goodwill |

|

|

|

|

16,169 |

|

|

|

|

||||

|

Total assets |

|

|

|

|

32,778 |

|

|

|

|

||||

|

Total debt (current) |

|

|

|

|

1,200 |

|

|

|

|

||||

|

Total liabilities |

|

|

|

|

4,141 |

|

|

|

|

||||

|

Total stockholders' equity |

|

|

|

|

28,637 |

|

|

||||||

So the company appears to be quite liquid with current assets well in excess of total debt.

The new combined entity had pro-forma sales and income as follows:

|

Nine Months Ended |

|

|

Year Ended |

|

|||||||||

|

|

|

|

(In thousands, except per share amounts) |

|

|||||||||

|

Pro Forma Statement of Operations Information |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Sales, net |

|

|

|

$ |

16,761 |

|

|

|

|

$ |

28,259 |

|

|

|

Operating (loss) income |

|

|

|

|

(9,676) |

|

|

|

|

|

596 |

|

|

|

Net (loss) |

|

|

|

|

(10,821) |

|

|

|

|

|

415 |

|

|

|

|

|

|

|

$ |

(0.34) |

|

|

|

|

$ |

0.01 |

|

|

Risks

This industry seems set for explosive growth. For small operators like Vapor Corp there is still an enormous amount of risk because there are loads of competitors and some of them are among the strongest corporations in the world.

Vapor Corp appears set to re-make its balance sheet upon the completion of the Varporin acquisition, but the company has yet to demonstrate positive operating cash flow.

To get pure play exposure to this industry there aren't many publicly traded options but diversification and reasonable position sizing are obviously crucial. The tobacco behemoths who are also in this business are going to be tough competition.

Risk level here is speculative to be sure. Maybe not at the industry level, but certainly at the company level.

Editor's Note: This article covers one or more stocks trading at less than $1 per share and/or with less than a $100 million market cap. Please be aware of the risks associated with these stocks.